Introduction

In Hong Kong’s fast-paced employment market, financial integrity has become a key part of responsible hiring. For roles that involve handling money, sensitive financial data, or leadership decisions, employers need more than just technical skills; they need confidence in a candidate’s trustworthiness. Conducting a bankruptcy check in Hong Kong is one practical way to gain this insight.

This check helps employers understand whether a candidate has faced significant financial difficulties in the past. When carried out fairly and in compliance with local regulations, they support better hiring decisions and reduce organisational risk.

Understanding Bankruptcy Background Checks

A Hong Kong bankruptcy background check is an assessment conducted by employers to determine whether a prospective employee has a history of bankruptcy. These checks typically involve reviewing bankruptcy background records, court documents, and financial databases to uncover any past financial insolvencies.

In Hong Kong, the Bankruptcy Ordinance (Cap. 6) governs this process, and the Official Receiver’s Office (ORO) manages the records. Employers usually access the information through the ORO bankruptcy search Hong Kong system for a fee.

While a bankruptcy check in Hong Kong does not automatically disqualify a candidate, it can be highly relevant in industries where financial judgment and responsibility are crucial, such as banking, insurance, and senior management positions.

Scope of Bankruptcy Checks: What’s Verified

A thorough employer bankruptcy background check in Hong Kong goes beyond a simple “yes” or “no.” It provides context and detail about a candidate’s financial history. Common areas reviewed include:

Bankruptcy Filings: Case numbers, filing dates, and whether the bankruptcy has been discharged.

Filing Dates: When the bankruptcy was filed, which helps determine how recent the issue was.

Discharge Status: Whether the bankruptcy has been formally resolved and the individual is free from obligations.

Individual Voluntary Arrangements (IVAs): Agreements with creditors to repay debts, which can indicate both financial struggle and repayment responsibility.

Compulsory Winding-Up Orders: If a company is liquidated and the candidate was a director or shareholder, this may signal potential risk.

Court Records: Public documents that provide additional verification and context.

These checks give employers a clearer picture of financial stability and responsibility, helping them decide whether a candidate is suitable for positions of trust.

Sectors and Roles Most Impacted by Bankruptcy Checks

While all businesses benefit from thorough screening, certain industries and roles place particular weight on financial history:

Banking & Financial Services: Positions that involve managing client funds, credit, or investments are vulnerable if an employee has a prior bankruptcy, as it may affect their risk management decisions or eligibility under regulatory requirements.

Insurance: Roles dealing with client premiums, claims, or asset management require a stable financial background, and a history of bankruptcy could be a red flag for regulatory or fiduciary concerns.

Senior Management & Strategic Roles: Executives and directors responsible for major financial decisions or company strategy may face heightened risk if they have previously declared bankruptcy, as it can reflect on their ability to handle corporate financial obligations effectively.

In sectors like banking, insurance, and senior management, conducting thorough financial background checks in Hong Kong helps ensure compliance and effective risk control.

Red Flags Employers Should Watch For

Not every bankruptcy background check finding is cause for concern. However, certain patterns or details may raise legitimate red flags:

Recent Filings: A bankruptcy declared in the past year or two may suggest ongoing financial stress.

Multiple Bankruptcies: Repeated filings can indicate chronic financial mismanagement.

Unresolved or Non-Dischargeable Debts: Such as unpaid taxes, which may continue to affect financial stability.

Legal Disputes Linked to Finances: Ongoing litigation can point to compliance or ethical concerns.

By identifying these warning signs, employers can perform a more thorough risk assessment, make informed hiring decisions, and ensure that candidates placed in positions of trust are financially responsible and reliable.

Balancing Risk with Fairness in Bankruptcy

It’s important to approach bankruptcy findings with fairness. Bankruptcy doesn’t always mean someone is irresponsible; it can result from external factors such as economic downturns, unforeseen medical expenses, or the failure of a business venture.

Employers should consider:

Timeframe: How recent was the bankruptcy? Older, resolved cases may carry far less weight than recent filings.

Underlying Reasons: Was the bankruptcy triggered by uncontrollable circumstances such as medical emergencies, market downturns, or external business failures, or by consistent financial mismanagement?

Resolution and Recovery: Has the bankruptcy been formally discharged? Has the candidate since taken steps to restore financial stability and demonstrate responsible management?

By weighing these factors, employers differentiate between one-off financial setbacks and ongoing risks. This measured approach mitigates potential liabilities and supports fair hiring practices, ensuring they do not unfairly exclude candidates due to past financial hardship.

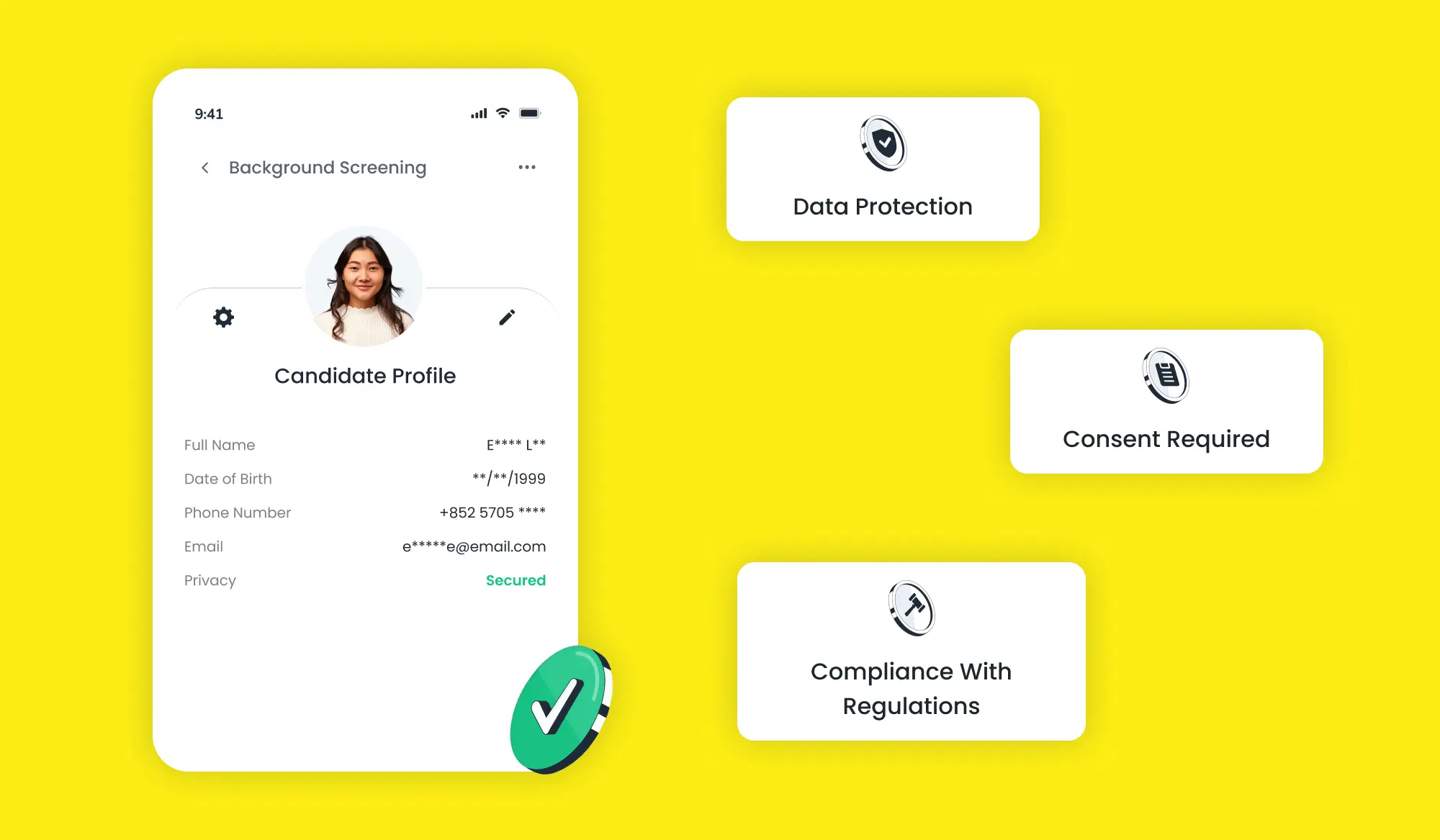

Legal Framework Governing Bankruptcy Checks in Hong Kong

Running bankruptcy checks in Hong Kong requires strict compliance with local privacy and data protection laws. The key piece of legislation is the Personal Data (Privacy) Ordinance (PDPO), Cap. 486, which governs how employers can collect, use, and store personal information.

For bankruptcy-related information, employers generally access records through the Official Receiver’s Office (ORO), which maintains the Bankruptcy Register. These records are public, but employers may use them only for legitimate purposes, such as assessing a candidate’s suitability for a financially responsible role.

When conducting these checks, employers in Hong Kong must ensure that:

Candidate Consent: Employers should obtain written consent before carrying out a bankruptcy check, as required under the PDPO’s data collection principles.

Legitimate Purpose: Employers must use information from the ORO only for recruitment and employment-related decisions, not for unrelated business purposes.

Data Minimisation: Only information relevant to the role should be collected. For example, reviewing a bankruptcy filing may be relevant for a senior finance role but excessive for an entry-level position.

Retention & Disposal: Records must not be kept indefinitely. Employers must set clear retention timelines and securely dispose of data when they no longer need it.

Non-Discrimination: Employment decisions must not breach the Disability Discrimination Ordinance, Sex Discrimination Ordinance, or other anti-discrimination laws. Employers should always assess bankruptcy history in context.

Because of these obligations, many Hong Kong employers rely on licensed background screening providers. These providers understand the requirements of the PDPO and the practical processes of accessing the ORO database, helping companies stay compliant while avoiding misuse of sensitive personal data.

Conclusion

A bankruptcy check in Hong Kong is not about penalising candidates for past financial struggles; it is about ensuring trust, compliance, and sound decision-making in roles where financial responsibility is critical.

By using a compliant bankruptcy background check process and reviewing reliable bankruptcy records, employers in Hong Kong can make sound hiring decisions while supporting fair employment practices. The result is stronger, more transparent hiring practices that benefit both businesses and employees.

Worried About Hiring Financially High-Risk Candidates?

Perform trusted Bankruptcy Checks in Hong Kong to safeguard your organisation.