Introduction

In the bustling corporate landscape of directorship checks in Hong Kong, where business opportunities are vast and competition fierce, hiring the right talent is paramount. Yet, an impressive resume can sometimes hide critical details: undisclosed business affiliations, potential conflicts of interest, or past corporate struggles. This is precisely why a directorship check isn’t just an option, but a vital safeguard for any employer in Hong Kong. Going beyond standard background screening, a directorship check delves into the public records of the Companies Registry, unearthing a candidate’s complete corporate footprint. For businesses navigating Hong Kong’s unique legal and economic environment, understanding these connections isn’t just due diligence; it’s fundamental to protecting your reputation, finances, and future.

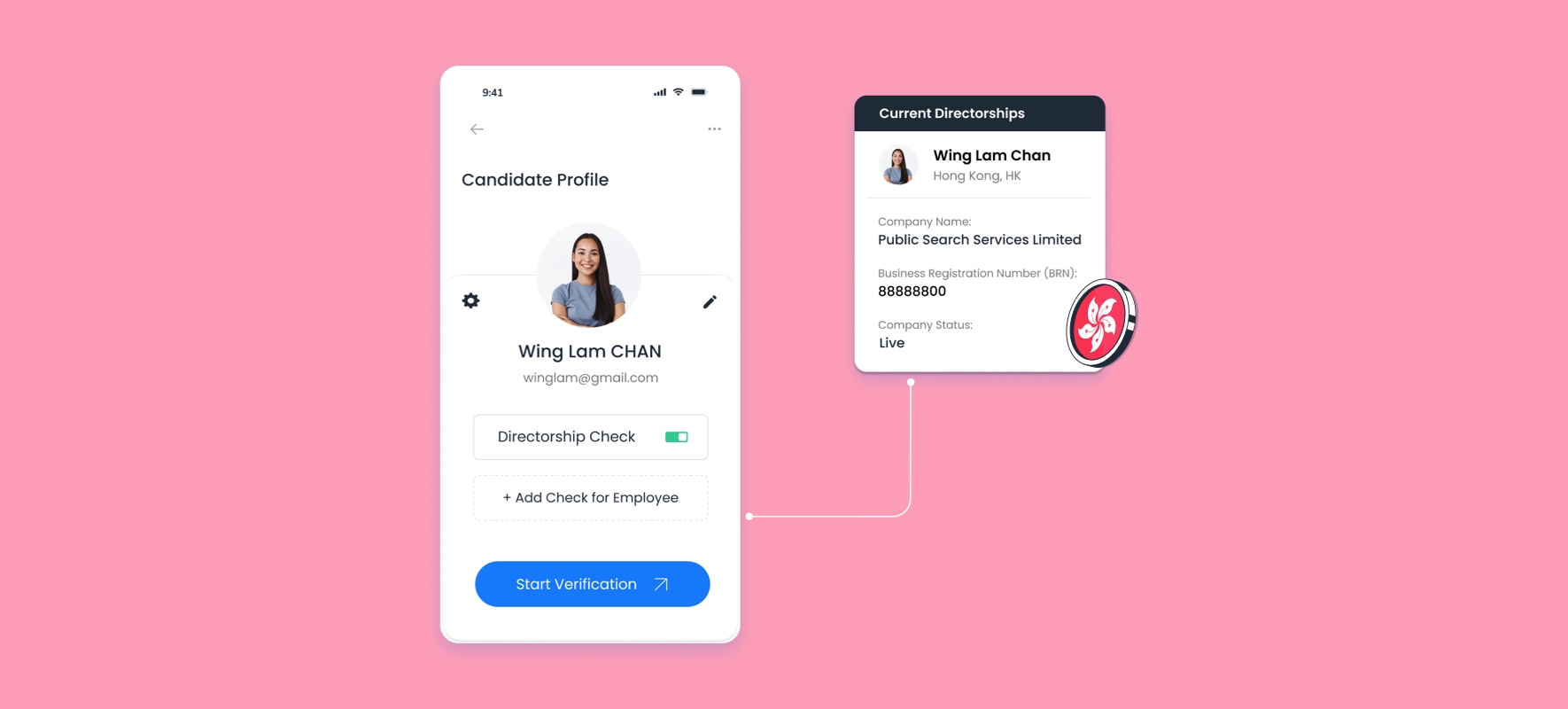

What is a Directorship Check?

A directorship check in Hong Kong involves a thorough review of public records to identify companies where a candidate has served in key roles. Partnering with professionals who specialize in Corporate Directorship Check Hong Kong ensures complete, compliant, and accurate insights drawn from the Companies Registry.

Director: Both executive and non-executive directors.

Alternate Director: Individuals appointed to act in a director’s absence.

Company Secretary: Responsible for ensuring compliance with company law.

Shareholder/Ultimate Beneficial Owner (UBO): Identifying significant ownership stakes.

Other key personnel: Depending on the depth of the check, this could include founders, partners, or significant controllers.

The primary source for this information in Hong Kong is the Companies Registry’s Integrated Companies Registry Information System (ICRIS). This online portal allows public access to a wealth of company data, including details on registered companies, their directors, company secretaries, registered addresses, and filing history.

Specific information typically revealed by a Hong Kong directorship check includes:

Full Registered Company Name(s): The precise legal names of all companies where the candidate is or was affiliated.

Company Registration Number: The unique identifying number assigned by the Hong Kong Companies Registry.

Nature of Role: Clearly indicating whether the candidate was a director, secretary, shareholder, etc.

Appointment and Cessation Dates: Crucial for understanding the duration of their involvement and their current status.

Company Status: Whether the company is active, dissolved, in liquidation, or struck off. This is vital for identifying any past failures or legal issues.

Registered Address of the Company: Provides insight into the company’s operational base.

Filing History: A general overview of the company’s compliance with statutory filing requirements (e.g., Annual Returns).

Charges/Mortgages: Publicly filed financial encumbrances against the company, which can sometimes indicate financial distress.

Why Directorship Checks are a Must for Hong Kong C-Suite Recruitment?

The benefits of conducting directorship checks are amplified in the Hong Kong business environment due to its unique characteristics:

Preventing Critical Conflicts of Interest:

- Competitive Landscape: Hong Kong is a fiercely competitive market. A candidate secretly holding a directorship in a competitor, a major client, or a key supplier could lead to severe breaches of confidentiality, unfair competitive advantages, or biased decision-making.

- Fiduciary Duties: For senior roles, particularly those involving board-level appointments or significant financial oversight, candidates owe a fiduciary duty to your company. Undisclosed directorships could present a clear conflict of this duty, potentially leading to legal repercussions under Hong Kong company law.

- Supplier/Vendor Relationships: Identifying if a candidate is a director of a potential or existing supplier can expose risks of favoritism, inflated pricing, or even fraud.

Uncovering Undisclosed Business Ventures & Time Commitments:

- Hong Kong’s entrepreneurial spirit means many individuals have multiple business interests. A directorship check reveals these ventures, allowing employers to assess potential distractions, time conflicts, or demands on the candidate’s energy that might impact their commitment to your role.

- It helps verify the completeness and accuracy of the candidate’s resume, as omitting significant business interests can raise questions about transparency and integrity. Conducting a Corporate Directorship Check in Hong Kong also helps identify potential conflicts of interest.

Assessing True Business Acumen and Risk Exposure:

- For executive, managerial, or financially sensitive roles, understanding a candidate’s past directorships provides tangible evidence of their experience in corporate governance, financial management, and strategic decision-making.

- Identifying past associations with dissolved or liquidated companies, or companies with a history of significant charges, allows for a deeper dive into the reasons for their failure. This can provide invaluable insight into a candidate’s risk assessment abilities and overall business judgment.

Enhancing Regulatory Compliance and Mitigating AML/CFT Risks:

- Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT): Hong Kong has a robust AML/CFT regime. For financial institutions and Designated Non-Financial Businesses and Professions (DNFBPs), directorship checks are crucial for Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) purposes. Hiring individuals with undisclosed links to suspicious entities or activities could expose your company to severe regulatory penalties, fines, and reputational damage.

- Fit and Proper Requirements: In regulated industries, directorship checks in Hong Kong are crucial to meet “fit and proper” requirements set by regulators such as the HKMA and SFC. Directorship checks contribute to this assessment by revealing past conduct or associations that might render a candidate unfit.

- Politically Exposed Persons (PEPs) and Sanctions: Directorship checks, especially when combined with global watchlist screening, can help identify if a candidate is a Politically Exposed Person (PEP) or linked to sanctioned entities. This is critical for AML/CFT compliance and managing associated risks.

Protecting Reputation and Brand Integrity:

Hiring someone with a history of involvement in disreputable or legally problematic companies can severely tarnish your organization’s image and trust among clients, investors, and the public. A directorship check acts as a vital reputational safeguard.

Getting Directorship Checks Right: Hong Kong’s Legal View

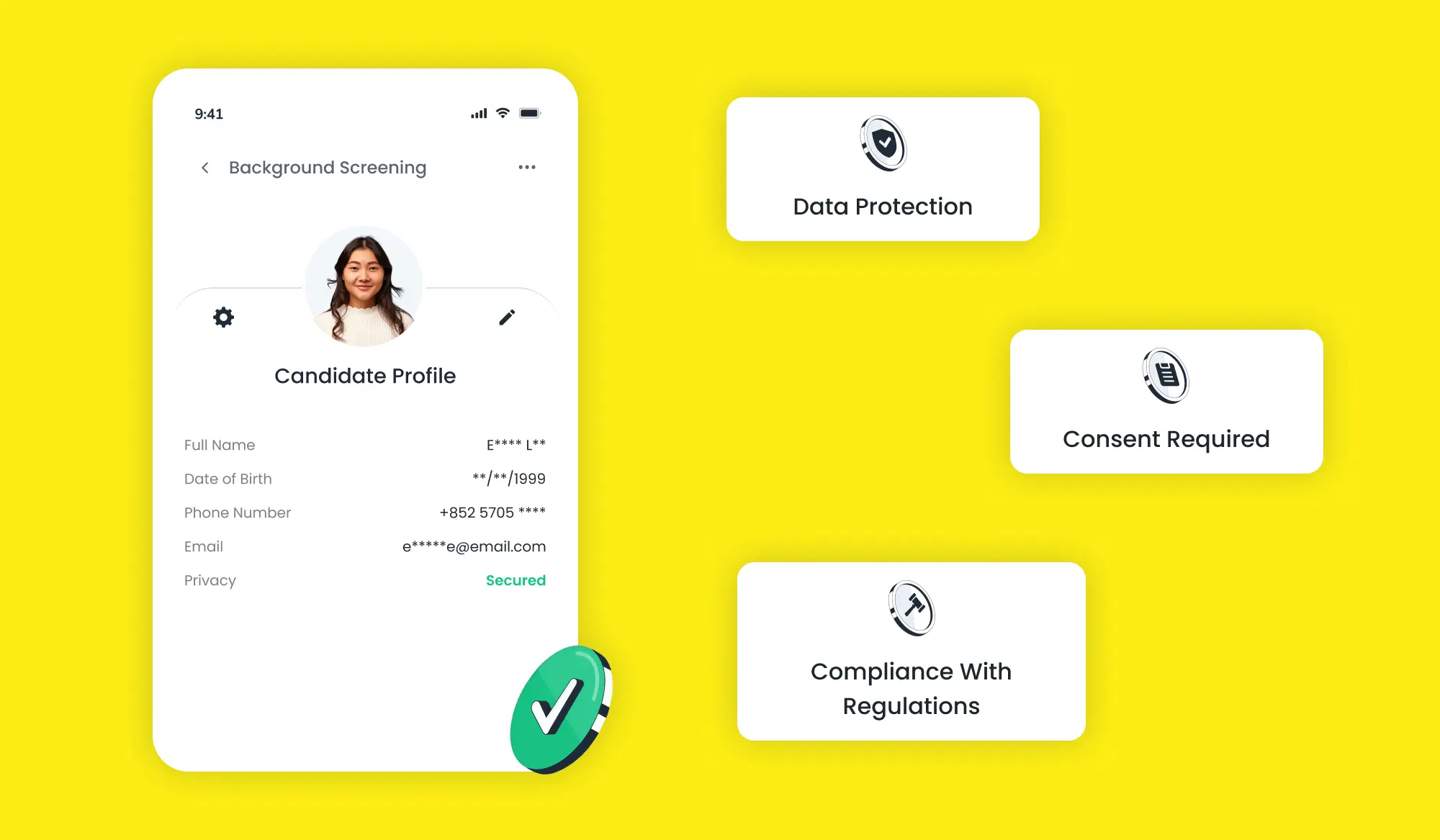

While directorship checks are legitimate and necessary, employers conducting directorship checks in Hong Kong must ensure compliance with the Personal Data (Privacy) Ordinance (PDPO) and maintain transparency throughout the process. Non-compliance can lead to significant fines and reputational damage.

Key PDPO principles and best practices for directorship checks:

Explicit Consent is Paramount: Before initiating any background check, including a directorship check, explicit, informed, and written consent must be obtained from the candidate. The consent form should clearly state the purpose of the check (e.g., “to assess suitability for employment, including identification of potential conflicts of interest and verification of professional background”). It should specify the types of data that will be collected (e.g., directorship information from public registries). The candidate must be informed that providing this data is typically voluntary, but failure to do so may impact their application.

Data Collection Principles (DPP1 – Purpose and Manner of Collection):

- Lawful and Fair: Data must be collected through lawful and fair means. Accessing public registries like ICRIS is generally considered lawful.

- Directly Related to Purpose: The data collected must be directly related to the stated purpose of employment screening and must be adequate but not excessive for that purpose. This means you should only collect information relevant to assessing their suitability for the role.

Data Accuracy and Retention (DPP2 & DPP5):

- Accuracy: Employers are responsible for taking all practicable steps to ensure the accuracy of the personal data collected. This often involves cross-referencing information and clarifying discrepancies with the candidate.

- Retention: Personal data should not be kept longer than is necessary for the fulfillment of the purpose for which the data was used. Once the hiring decision is made and any legal obligations fulfilled, unnecessary data should be securely deleted.

Data Use (DPP3): The collected data can only be used for the purpose stated at the time of collection (i.e., employment screening). It cannot be used for any new or unrelated purpose without obtaining fresh consent.

Transparency and Data Access (DPP4 & DPP6): Candidates have the right to be informed about how their data is being processed and to request access to their personal data held by the employer. They also have the right to request corrections if the data is inaccurate.

Rehabilitation of Offenders Ordinance (ROO): While the ROO primarily pertains to criminal convictions, it’s worth noting that Hong Kong has provisions to protect individuals from discrimination based on “spent” convictions. However, directorship information from public registries generally falls outside the scope of the ROO unless it relates directly to a criminal offense that would be “spent.”

Advanced Considerations & Nuances for Directorship Check

Beyond the fundamental aspects, employers in Hong Kong should be aware of these advanced considerations:

Shadow Directorships / De Facto Directors: While public registry checks reveal formal appointments, a “shadow director” or “de facto director” is someone who acts as a director but is not formally appointed. These are harder to detect through directorship checks for employment alone, but might be inferred from other comprehensive due diligence efforts like extensive adverse media searches, regulatory filings, or even direct inquiries. While not directly caught by a standard directorship check, their existence highlights the need for a holistic screening approach, especially for critical roles. These complexities show why a professional Corporate Directorship Check Hong Kong is essential for uncovering shadow directorships, cross-border affiliations, and offshore ties.

Interpreting “Striking Off” vs. “Liquidation”:

- Striking Off: This can happen voluntarily (e.g., a dormant company with no assets or liabilities) or involuntarily due to non-compliance (e.g., failure to file annual returns). A voluntary strike-off might be benign, but an involuntary one could signal past regulatory neglect.

- Liquidation: This process usually indicates a company’s financial distress and inability to pay its debts. While not always a reflection of director misconduct, it warrants careful investigation into the circumstances, especially if the candidate was a director during the period of financial decline.

Dormant Companies: In Hong Kong, a company can be declared “dormant” if it has no significant accounting transactions. A candidate might legitimately be a director of a dormant company (e.g., a holding company for personal assets, a long-term investment vehicle, or a future venture yet to launch). This is generally not a red flag unless it conflicts with the terms of their employment with your company regarding outside business interests.

Corporate Structures in Hong Kong: Hong Kong’s flexible corporate laws allow for complex structures, including the use of holding companies, shell companies (often for legitimate purposes like tax planning or asset protection), and multi-layered entities. Understanding this context helps interpret directorship findings. A candidate being a director of a shell company, for instance, might be a standard part of their personal or professional financial planning, not necessarily a red flag.

Cross-Jurisdictional Directorships (especially China & Offshore):

- Mainland China: Accessing directorship information for companies registered in Mainland China is significantly more complex due to different legal frameworks and data access regulations. It often requires specialized local partners and can be time-consuming. For candidates with extensive Mainland China business ties, this can be a critical but challenging aspect of the check.

- Offshore Jurisdictions: It’s common for Hong Kong residents and businesses to have directorships in offshore jurisdictions like the British Virgin Islands (BVI), Cayman Islands, or Bermuda, often for tax efficiency, asset protection, or international trade. Checking these involves separate processes and costs for each jurisdiction, and the level of publicly available information can vary significantly. For senior roles, international checks are frequently essential to gain a full picture of a candidate’s global corporate affiliations.

Challenges and Nuances Specific to Directorship Check in Hong Kong

While Hong Kong offers excellent access to company data, certain nuances can present challenges:

Chinese Names and Aliases: Many individuals in Hong Kong use both an English name and a Chinese name. Thorough checks require searching both, as well as any known aliases.

Common Names: Very common names can yield a large number of search results, requiring careful cross-referencing with other identifying information (like date of birth, HKID number if provided, or past addresses) to ensure accuracy.

Interpretation of Information: Raw registry data can be complex. Professional agencies provide expert interpretation and context, which is vital for non-legal professionals.

Best Practices for Conducting Directorship Checks

To effectively leverage directorship checks in your hiring process:

Tiered Approach to Screening:

- Mandatory for Senior/Sensitive Roles: Directorship checks should be mandatory for C-suite positions, board members, senior management, roles with financial oversight, business development roles, compliance officers, and any position with access to highly sensitive company information or client data.

- Consider for Mid-Level Roles: For mid-level managerial or specialized roles, evaluate the necessity based on the level of responsibility and access.

Strategic Timing in the Hiring Process: Conduct the directorship check after initial interviews and when you have a serious interest in a candidate, but before extending a final offer. This optimizes resources and ensures you’re only checking serious contenders. Always obtain the candidate’s explicit written consent at the appropriate stage.

Transparent Candidate Communication: Clearly explain to candidates that a directorship check is part of your standard background screening process, outlining its purpose (e.g., “to assess for potential conflicts of interest and verify professional background”). Be open about the information you are seeking and assure them of data privacy in accordance with PDPO.

Handling Adverse Findings (Clarification, Not Condemnation): If a directorship check reveals concerning information, do not immediately disqualify the candidate. Instead, schedule a follow-up discussion. Allow the candidate an opportunity to explain the findings, provide context, or clarify any discrepancies. There may be legitimate reasons for what appears to be a red flag. Develop an internal Risk Assessment Framework to evaluate the severity and relevance of any findings to the specific role. What might be critical for a financial director might be less impactful for a junior marketing executive. For highly complex or legally sensitive findings, seek legal counsel to understand the implications under Hong Kong law.

Leverage Professional Background Screening Agencies: This is the most efficient and compliant approach. Agencies have direct access to relevant databases, experience in navigating the nuances of Hong Kong’s Companies Registry, and are experts in PDPO compliance. They can handle the complexities of common names, Chinese names, and potential international directorship searches. They provide clear, consolidated reports, saving your HR team significant time and effort.

Cost-Benefit Analysis: While professional background screening involves a cost, consider it an investment. The potential costs of a bad hire, including financial losses from fraud or conflicts of interest, legal fees from non-compliance, reputational damage, and the time and expense of re-recruiting, far outweigh the cost of a thorough check.

Conclusion

- Mitigate financial, legal, and reputational risks. Ensure compliance with AML/CFT and regulatory requirements.

- Foster a culture of transparency and integrity within the organization.

- Make truly informed hiring decisions that protect the company’s future.

Secure your leadership team with directorship checks

Conduct professional directorship checks in Hong Kong to protect your organization and promote reliable hires.