Introduction

When it comes to hiring, speed isn’t just about efficiency; it’s about winning the right talent before someone else does. To achieve this, every step in your hiring process must operate smoothly and efficiently. Yet, despite having a fast and structured workflow, many organizations still face delays at one key stage: background verification. A slow or inefficient pre-employment background check can stall your hiring process, frustrate candidates, and increase administrative costs.

With competition for top talent growing tighter than ever, organizations can’t afford unnecessary delays. That’s why many are rethinking how they conduct background checks, making it faster, smarter, and fully compliant without compromising accuracy or trust.

Why Faster Pre-Employment Background Checks Matter

In a market where every day counts, time is more than just a metric; it’s a hiring advantage. The speed of your pre-employment background checks can determine whether you secure top talent or lose them to a faster-moving competitor. Beyond efficiency, timely verification also strengthens trust, compliance, and candidate satisfaction, ensuring your hiring process is both fast and reliable.

Why Slow Background Checks Hurt Your Business

When background checks drag on, it’s not just a scheduling issue that directly affects your business performance and reputation.

Candidate Drop-Off: Top talent doesn’t wait. Extended verification timelines often push candidates to accept competing offers, especially in high-demand industries. This results in losing the best hires simply due to a procedural delay.

Higher Hiring Costs: Each extra day spent verifying documents adds to your recruitment spend from prolonged job postings and repeated interviews to additional administrative time. A slow process increases your cost per hire significantly.

Compliance Risks: In an effort to rush at the end, incomplete or inconsistent checks may slip through. This exposes employers to potential compliance violations, reputational risks, and in some cases, legal challenges.

Why Faster Background Checks Make Everything Better

Speed brings far more than convenience; it enhances trust, safety, and the overall candidate experience both for the applicant and the employer.

Better Candidate & Employer Experience: A timely, transparent pre-employment background check process builds confidence on both sides for both candidates and employers. Candidates feel respected when the process is smooth, quick, and communicative, while employers project professionalism, efficiency, and trustworthiness throughout the hiring journey.

Higher HR Efficiency: Automation and standardized workflows reduce manual effort, eliminate redundant tasks, and free HR teams to focus on strategic decision-making rather than document chasing.

Improved Trust and Safety: Fast doesn’t mean careless. With the right tools, you can complete checks quickly and maintain high accuracy, ensuring every hire is safe, verified, and compliant with data protection standards.

Strategies to Speed Up Pre-Employment Background Checks

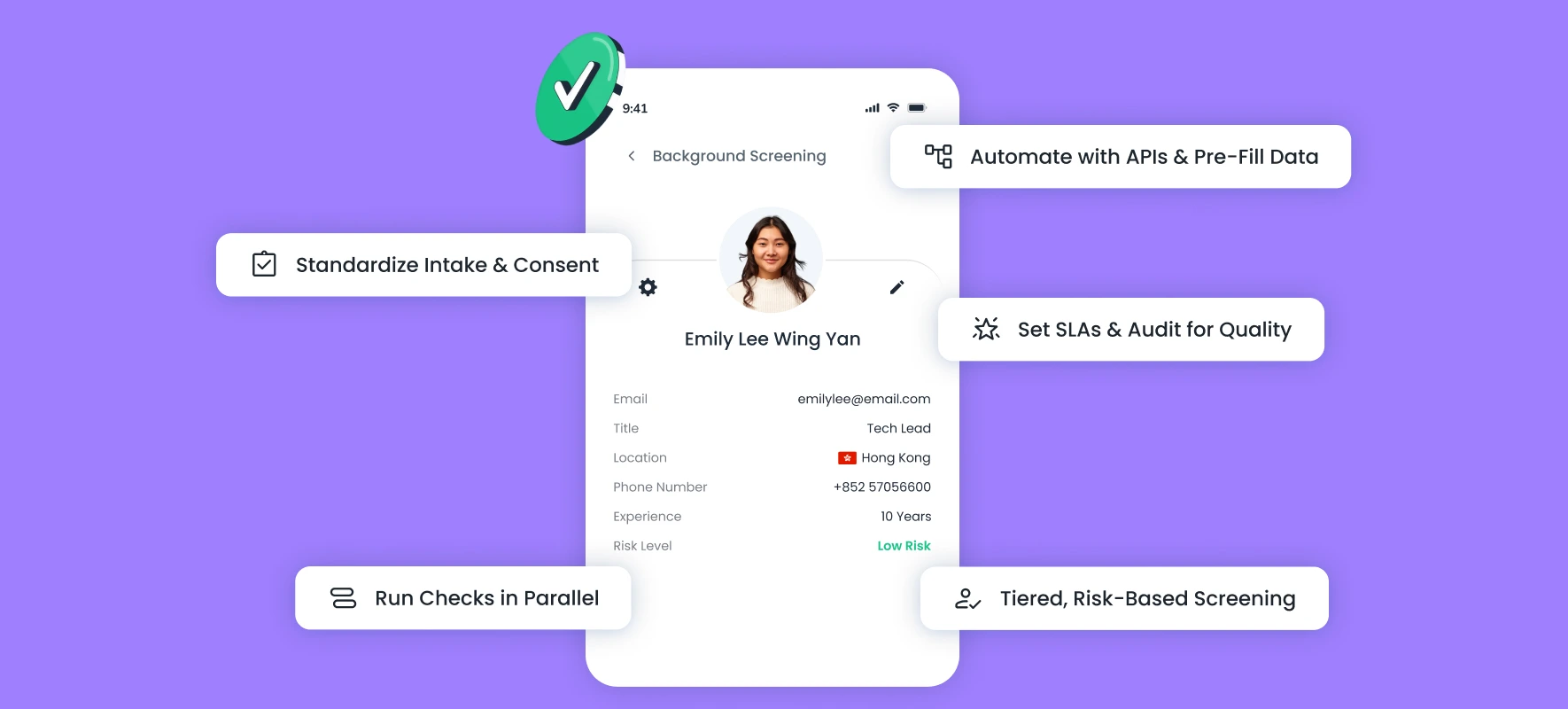

A modern background check strategy combines automation, structured workflows, and risk-based screening. Here’s how to make every step faster without cutting corners.

Strategy 1: Standardize Your Intake and Consent Process

Why it matters: Disorganized candidate data and missing consent forms are among the biggest bottlenecks in verification. Standardizing your intake process ensures data accuracy and faster initiation of checks.

How to implement:

- Use a single digital form for candidate details and consent.

- Create predefined document checklists for each role or department.

Pro Tip: Automate candidate reminders for incomplete submissions. This alone can reduce delays by 15-20%.

Result: Streamlined onboarding with fewer follow-ups and faster start times.

Strategy 2: Adopt a Tiered, Risk-Based Screening Approach

Why it matters: A one-size-fits-all verification process can slow down hiring and waste valuable time. Different job categories carry different levels of risk and responsibility, which means their pre-employment background checks should be tailored accordingly.

How to implement:

- White-Collar Professionals (CEOs, Directors, Managers, CFOs, Lawyers, Doctors, HRs): Conduct in-depth checks, including ID checks, directorships, civil litigation, bankruptcy, adverse media checks, employment history, and professional qualifications.

- Grey-Collar Employees (Laboratory Technicians, Teachers, IT Support, Chefs): Focus on employment and education verification, reference checks, CV validation, and credit history as relevant to role sensitivity.

- Blue-Collar Workers (Construction Labourers, Machine Operators, Repair Technicians, Delivery Drivers): Emphasize ID verification, driver’s license checks, address and criminal checks, references, and, in most cases, civil litigation screening for added trust.

Pro Tip: Tiered screening saves significant time by aligning the depth of checks with the risk level of each job type, ensuring efficiency without compromising compliance.

Result: A smarter, risk-aligned pre-employment screening process that’s faster, focused, and fully compliant with industry standards.

Strategy 3: Automate Using Pre-Built Integrations & APIs

Why it matters: Manual data transfer and multiple logins slow down every stage of verification.

How to implement:

- Integrate your screening system with existing HR tools (like your ATS or HRIS).

- Configure triggers to automatically start checks when a candidate reaches the “offer” or “onboarding” stage.

Pro Tip: API-based integrations can reduce turnaround time by up to 40%, ensuring instant data flow.

Result: Consistent, error-free processes with zero duplication.

Strategy 4: Pre-Fill Data and Reduce Back-and-Forth

Why it matters: HR teams waste valuable time chasing incomplete or inaccurate candidate information.

How to implement:

- Use self-service portals that auto-populate data from resumes or LinkedIn profiles.

- Validate details (like address or ID) instantly to catch errors early.

- Enable candidates to upload required documents in one secure step.

Pro Tip: Automated reminders for pending uploads keep the process on track.

Result: Cleaner data, fewer corrections, and faster report generation.

Strategy 5: Run Checks in Parallel

Why it matters: Sequential verification (one check after another) dramatically increases turnaround time.

How to implement:

- Use systems that launch multiple checks on ID, education, and criminal records simultaneously.

- Monitor progress through unified dashboards showing real-time status.

Pro Tip: Parallel workflows can reduce processing time by 25-30%, especially for multi-country verification.

Result: Quick, accurate results with no bottlenecks.

Strategy 6: Build Vendor SLAs & Monitor Turnaround Metrics

Why it matters: You can’t optimize what you don’t measure. Vendor accountability is essential for consistent speed.

How to implement:

- Define clear SLAs (e.g., criminal record check: 3 days; education check: 7-15 days).

- Use dashboards to track progress and flag delays automatically.

- Schedule monthly reviews to discuss SLA adherence.

Pro Tip: Proactive vendor management leads to predictable timelines and fewer escalations.

Result: Faster, more reliable reporting cycles.

Strategy 7: Maintain Quality & Compliance via Continuous Auditing

Why it matters: Faster doesn’t mean riskier. Accuracy and compliance must remain top priorities.

How to implement:

- Conduct regular audits on random report samples.

- Stay updated with evolving privacy and labor laws.

- Maintain authenticity checklists for document verification.

Pro Tip: Appoint a compliance officer or audit lead to oversee quality control.

Result: Speed, reliability, and compliance all working together.

Traditional Screening vs Modern (Human and AI) Background Checks

In the past, background verification relied heavily on manual calls, paperwork, and fragmented databases, a time-consuming process prone to human error. But today, modern platforms combine AI automation with human expertise, delivering faster, more reliable, and compliant results.

| Aspect | Traditional Screening | Modern (Human and AI) Screening |

|---|---|---|

| Process Type | Manual data collection and phone/email verification | Manual data collection and phone/email verification |

| Turnaround Time | 5 - 10 business days | 24 - 48 hours (depending on checks) |

| Error Rate | Higher due to manual entry | Reduced via AI-powered data matching |

| Scalability | Hard for bulk hiring | Highly scalable with cloud automation |

| Candidate Experience | Repetitive, slow communication | Streamlined, mobile-friendly workflows |

| Compliance | Manual document checks | Built-in compliance filters & audit trails |

| Cost Efficiency | Labour-intensive, expensive | Optimized through automation |

| Accuracy & Reliability | Depends on the verifier's skill | AI and human cross-validation ensure precision |

Conclusion

Speeding up pre-employment background checks isn’t just about delivering reports faster; it’s about creating a more intelligent, transparent, and reliable hiring process.

By combining standardized workflows, automation, and ongoing compliance reviews, HR teams can cut turnaround times dramatically, often from two weeks to as little as 3-8 days, without losing accuracy or credibility.

The ultimate goal isn’t simply to be quick, but to be quick and correct. With the right strategy, technology, and process discipline, your pre-employment screening can become a true competitive advantage, helping you hire faster, smarter, and with complete peace of mind.

Background Checks Done in 3 Days!

Accelerate your hiring process with our efficient, compliant, and reliable verification solutions.